The page shall give you an idea about the Kamyab Nojawan GOV PK Imran Khan Loan Scheme 2023 Online Application Form. Now get the opportunity to expand your business Prime Minister’s Kamyab Jawan – Youth Entrepreneurship Scheme (YES) reading at lahorecafe. You pay a visit because you seem interested in the following topics. What every you Say.

So as to inspire the young people of the nation by offering chances to use their innovative potential without limit, the Government of Pakistan is offering ease business credits up to Rs. 5,000,000/ –

Kamyab Nojawan GOV PK Imran Khan Loan Scheme 2023 Online Application Form

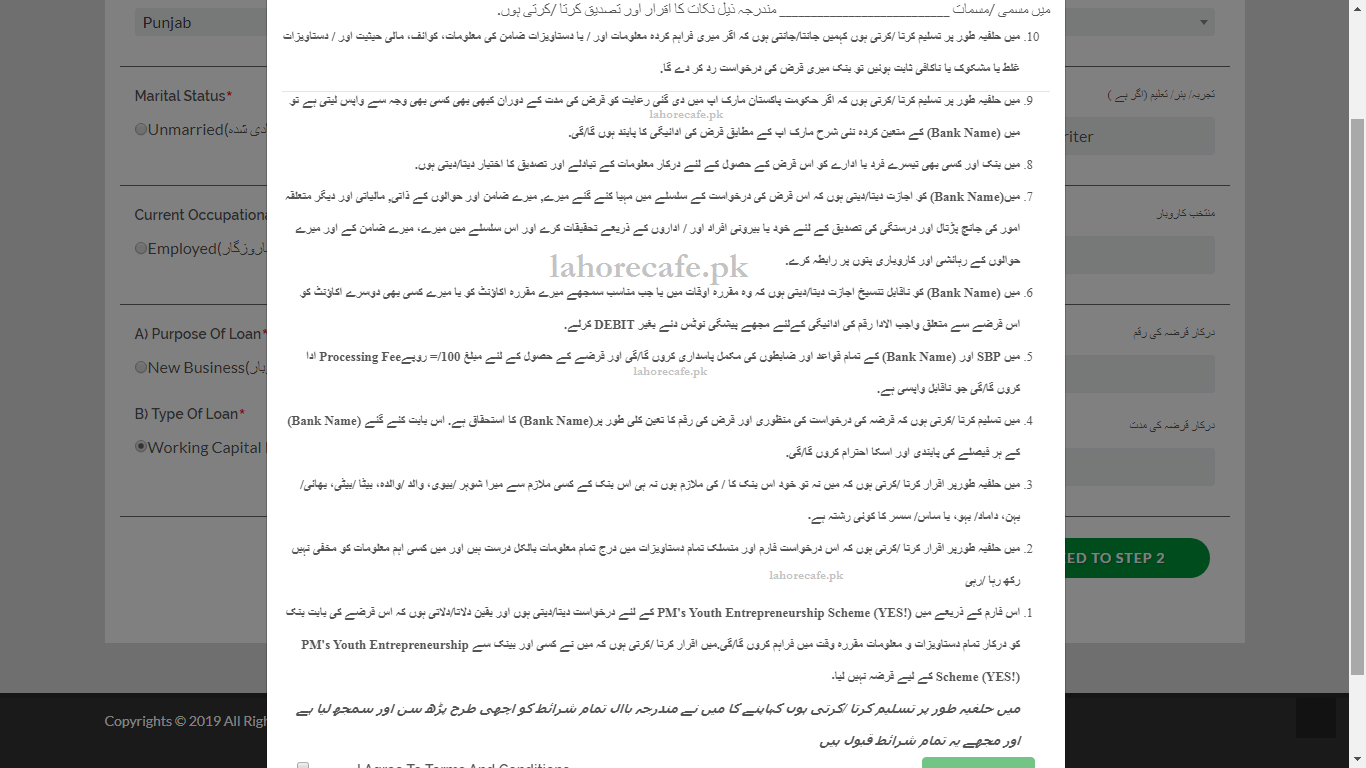

Online form ka Link Neechay Diya hova ha

or jb main ny Online form fill kiya tu ya affidavit bi yes krna para

When I agreed with the affidavit I received a message from 8666

Free Invoice Template Excel Online

Dear Applicant Your Loan Application has been submitted. The concerned Bank will Contact You on Next Working Day

Credits can be beneficial for setting up new businesses or the development of existing ones.

1. PM Loan Scheme Last Date

2. Imran Khan Loan Scheme 2023 Application Form

3. Youth Loan By Imran Khan

4. Imran Khan Loan Scheme Form

5. Loan Scheme Imran Khan 2023

6. PM Loan Scheme for Youth

7. PM Loan Scheme 2023

8. PM kamyab jawab Scheme

9. Kamyab jawan loan application form

10. Kamyab Jawam Program Loan application form

11. Kamyab Jawan Program Loan NBP

12. kamyab jawab loan scheme 2023 form

13. government loan scheme 2023

| Salient Features of YES | ||||

| Eligibility Criteria |

|

|||

| Focus on Women | 25% of the loans will go to women borrowers | |||

| Loan Size and Security | Loan Amount | Security Requirement | ||

| Tier I (T-1) | Rs. 100,000/- to Rs. 500,000/- | Clean loan, only personal guarantee of the borrower | ||

| Tier II (T-II) | Rs. 500,001/- to Rs. 5,000,000/- | 1. Commercial Vehicle 2. Gold Ornaments 3. Government Securities 4. Mortgage of Property | ||

| Loan Type |

|

|||

| Loan Tenor | Up to 8 Years with Maximum Grace Period of up to 1 Year | |||

| Debt to Equity Ratio |

The borrower’s contribution of equity will be in the form of cash or immovable property and will be required after approval of the loan. |

|||

| Pricing |

|

|||

| Fees & Charges |

Charges of all sorts will only be payable by successful applicants |

|||

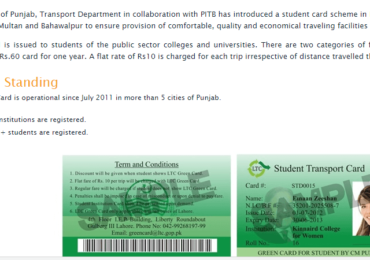

Every single qualified individual can apply for the credit by visiting the assigned online entryway (to be reported by GOP) or look for help from every single taking part bank for example National Bank of Pakistan, The Bank of Khyber, and The Bank of Punjab. No other method of utilization accommodation other than through assigned online entry ought to be worthy.

It is important to stay in touch with the Nojawan program as per the requirements of. Further, get the idea of Kamyab nojawan online apply and online apply

It is important to stay updated about the future perspective for the coming scheme. Although the scheme launched you can get an idea about the factor analysis. I personally applied on 2023. Still, on 23 Oct 2023, I am not getting any call or SMS from the BOP bank indeed, You are more than welcome to share here about your approach to the scheme after applying through the comment section and we will publish the content.

loan

good program

For loan application

i am not getting any call or sms from 8666

Dear metrit list kab lagy ge iski

yeh loan kab tak milay ga

premier colony st#2 house#114 faisalabad

Sir please I apply this sceam

Sir

Sir/Madam,

I applied for one million for expansion of business under this scheme. A message received from 8666 that your application is verified from NADRA, bank will contact you soon. I inquired concerned bank about this message, but management of the bank said that they did not receive your application. What should i do next?

AOA bro

status is same here

i have check with all the department of the bank as a lots of my relative and friends are working as executive in that particular bank where i apply for loan but no record found.

AoA. I received a message today with an account top up of 950 rupee. Are they serious??? Means you’re lending someone 950 rupees and asking him to start a business…

i want loan

Same to you bro what is your net step

Dear Applicant, Ghulam yasin! Your loan application has been received by Akhuwat Islamic Microfinance after verification from Nadra.The bank will contact you for further required procedures as mentioned in the FAQs section on the website.

Kia 8666 sms code pm youth loan schme ka hy

I need a loan but how I get it

Muja bohot zaror ha is loan ki